Issue 1: The Islamic Finance Infrastructure Gap No One is Talking About

The gap between Islamic finance principles and digital implementation explained. Why most organizations digitize forms without digitizing substance, and the four infrastructure pillars needed to bridge this gap: asset representation, ownership mechanics, profit distribution, and verification.

Welcome to our newsletter, "Islamic Fintech in Action" from Blade Labs, creators of the ZeroH platform. We deliver practical insights on implementing Islamic finance principles in today's digital environment, focusing on how rather than just what.

In this inaugural issue, we address the critical gap between Islamic finance theory and digital implementation - a challenge costing the industry years in innovation cycles.

Watch for our next issue ahead of 4th MENA Insuretech Summit 2025 (starting May 10th), where our CEO will be discussing the future of money and digital assets on the "Beyond Currency" panel on May 11th.

The Digital Transformation Challenge

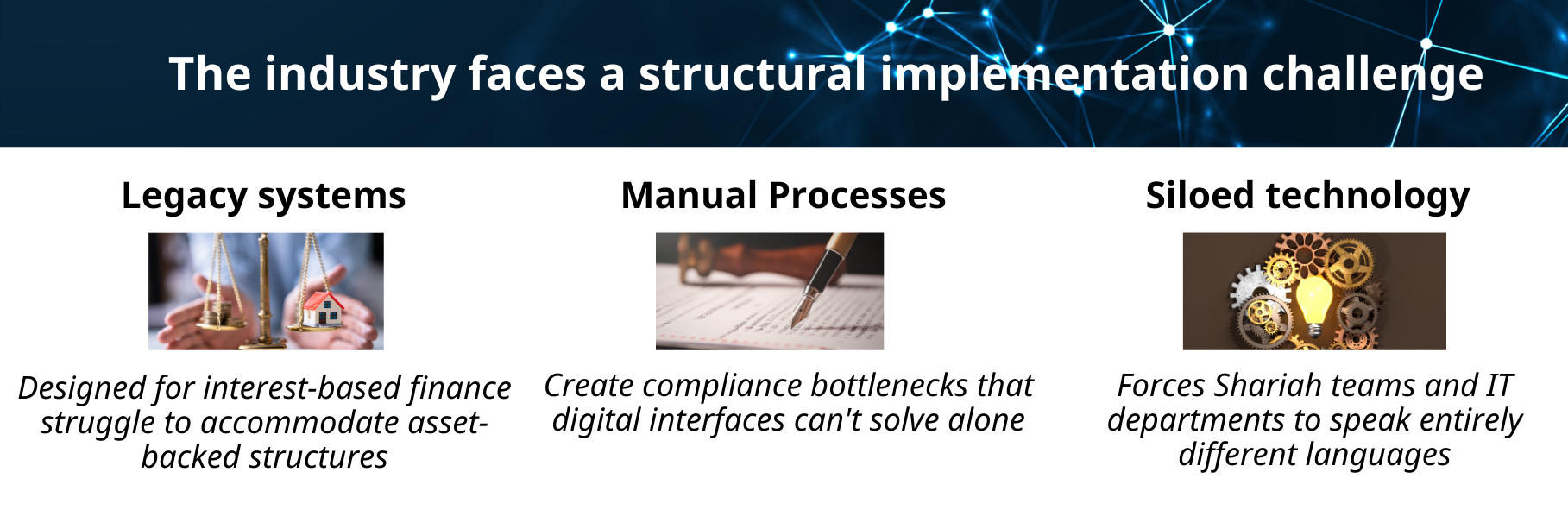

Islamic finance was designed to be fundamentally different from conventional finance - built on real asset ownership, genuine risk-sharing, and ethical principles. Yet today's implementation landscape reveals a critical gap:

This implementation gap explains why despite $3.38 trillion in global Islamic assets (IFSB 2023), digital innovation has lagged conventional finance by 3-5 years.

The uncomfortable truth? We've digitized forms without digitizing substance.

Forward-thinking institutions are addressing these implementation gaps through unified teams where technical and Shariah expertise develop solutions collaboratively rather than sequentially.

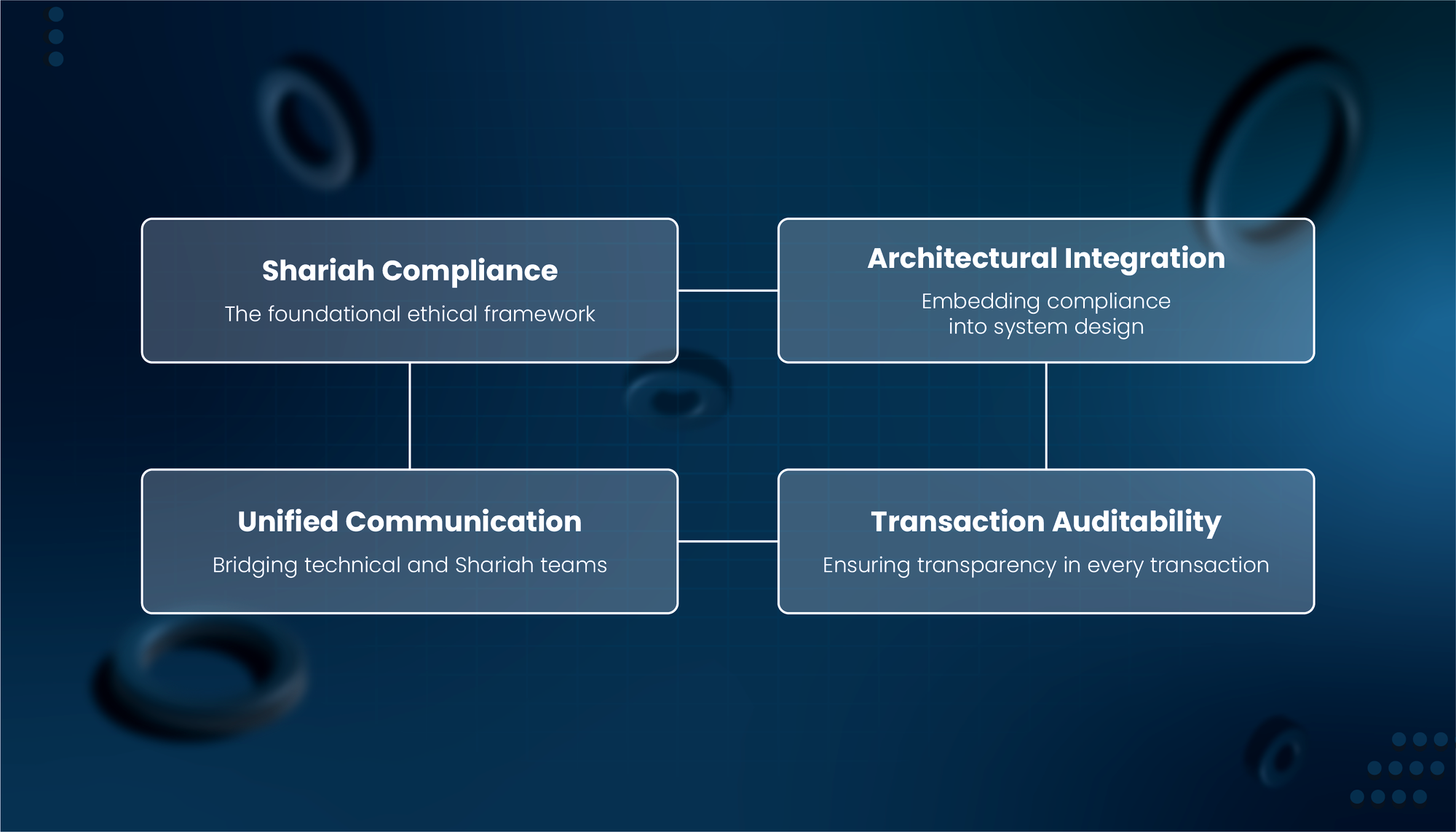

Solving the implementation gap requires rethinking infrastructure from first principles:

1. Asset Representation Layer - Digital representations must maintain direct connection to physical assets

2. Ownership Transfer Mechanics - Technical workflows must mirror Shariah-compliant ownership sequences

3. Profit Distribution Systems - Automated calculations that respect risk-sharing principles

4. Audit & Verification Frameworks - Transparent, immutable records that satisfy both regulators and Shariah boards

Organizations that build on these four pillars avoid the common pitfall of merely digitizing documents while ignoring structural requirements.

Understanding the Path Forward

Islamic finance isn't just conventional finance minus interest - it's a fundamentally different conceptual model requiring purpose-built infrastructure.

At Blade Labs, this first-principles understanding drives our research and development. While our ZeroH platform incorporates these insights, the principles themselves apply regardless of your technology stack:

• Embed, don't add - Shariah compliance must be architectural, not decorative

• Unify, don't translate - Create systems where technical and Shariah teams speak one language

• Verify, don't trust - Build auditability into every transaction, not just final outputs

Our Expertise

Blade Labs combines deep understanding of Islamic finance structures with technical implementation experience:

• Fatwa-Certified Framework - Our approach has been formally certified by the Amanie Shariah Supervisory Board for compliant implementation of Murabaha, Ijara, and Musharakah.

Reimagining Livestock Finance: A Call for Collaborative Innovation

Despite owning billions in livestock assets, millions of smallholder farmers worldwide remain financially excluded because these living assets can't be effectively verified or tracked. Our latest research explores a promising solution at the intersection of Islamic finance and digital identity technology.

This initiative brings together Islamic financial institutions, technology providers, and agricultural organizations to test and refine solutions for livestock verification and financial inclusion.

Read on to discover how your organization might participate in building this innovative pathway to financial inclusion. [Link to article]

Milestones that Matter

Industry accolades that affirm our commitment to scalable, compliant Islamic finance.

Finopitch 2025 Grand Prize Winner

ZeroH was awarded the Grand Prize at Finopitch 2025 in Tokyo, recognized for proving that Islamic finance can scale with integrity and precision.

🔗 View the Official Press Release from Finopitch

Best Islamic FinTech Startup – Global Islamic Fintech Awards 2025

In April, we were named Best Islamic FinTech Startup at the Global Islamic Fintech Forum in Dubai for our Blockchain-first infrastructure.

ZeroH replaces procedural trust with programmable trust. It's not a tool—it's the absence of fragility.

As consumer demands shift toward responsible finance, Diminishing Musharakah emerges as a viable alternative to conventional auto loans. By exploring its benefits and challenges, especially with innovations from ZeroH, this article delves into how technology is transforming Islamic finance in the auto sector.

📖 Read: How Diminishing Musharakah and Technology Are Reshaping Islamic Auto Finance

For those ready to see these principles in action: [Request a ZeroH platform overview]

Stay Connected

Website: bladelabs.io, zeroh.io

Contact: hello@bladelabs.io

LinkedIn: Blade Labs