Rethinking GRC for a Changing Regulatory Reality

Why GRC is Ripe for Disruption?

Over the past few years, compliance platforms have evolved rapidly, with many focusing on improved usability and incremental automation. At the same time, growing regulatory complexity is prompting organizations to reassess whether these improvements are sufficient for what lies ahead.

This tension is reflected in a 2025 global GRC benchmarking survey by McKinsey, which notes that governance, risk, and compliance remain “a work in progress” for most organizations, with significant room for improvement in how GRC is enabled and executed.

Recent advances in AI and regulatory intelligence are making it possible to move beyond incremental gains toward fundamentally different ways of managing compliance. As a result, organizations that continue to evaluate platforms using criteria shaped by 2020-era capabilities risk investing in solutions already out of step with what is now achievable.

The Convergence Reshaping Compliance

Three forces are converging to change how organizations approach governance, risk, and compliance (GRC):

1. AI Capabilities Are Advancing Beyond Simple Automation

AI adoption in compliance is no longer just about automating repetitive tasks. As we move towards intelligent infrastructural support for complex compliance workflows, generative AI and machine learning systems are being evaluated and adopted to analyze regulatory material, improve monitoring, and enhance risk assessment. As a matter of fact, AI can process and interpret large regulatory text corpora, help reduce manual review burdens, and support continuous compliance monitoring.

2. Regulatory Complexity Has Increased Substantially

Organizations are increasingly required to manage multiple, overlapping, and frequently updated regulatory frameworks, such as PCI DSS 4.0, SOC 2, ISO 27001, NCA ECC, the SAMA Cyber Security Framework, and emerging requirements like DORA, often simultaneously.

As regulatory update cycles accelerate and interpretations become more nuanced, compliance efforts are stretching beyond what periodic implementation projects or incremental headcount increases can realistically support. Compliance teams are no longer just implementing standards; they are continuously interpreting, reconciling, and maintaining them across jurisdictions and control environments.

3. Organizations Are Feeling the Limits of Incremental Improvement

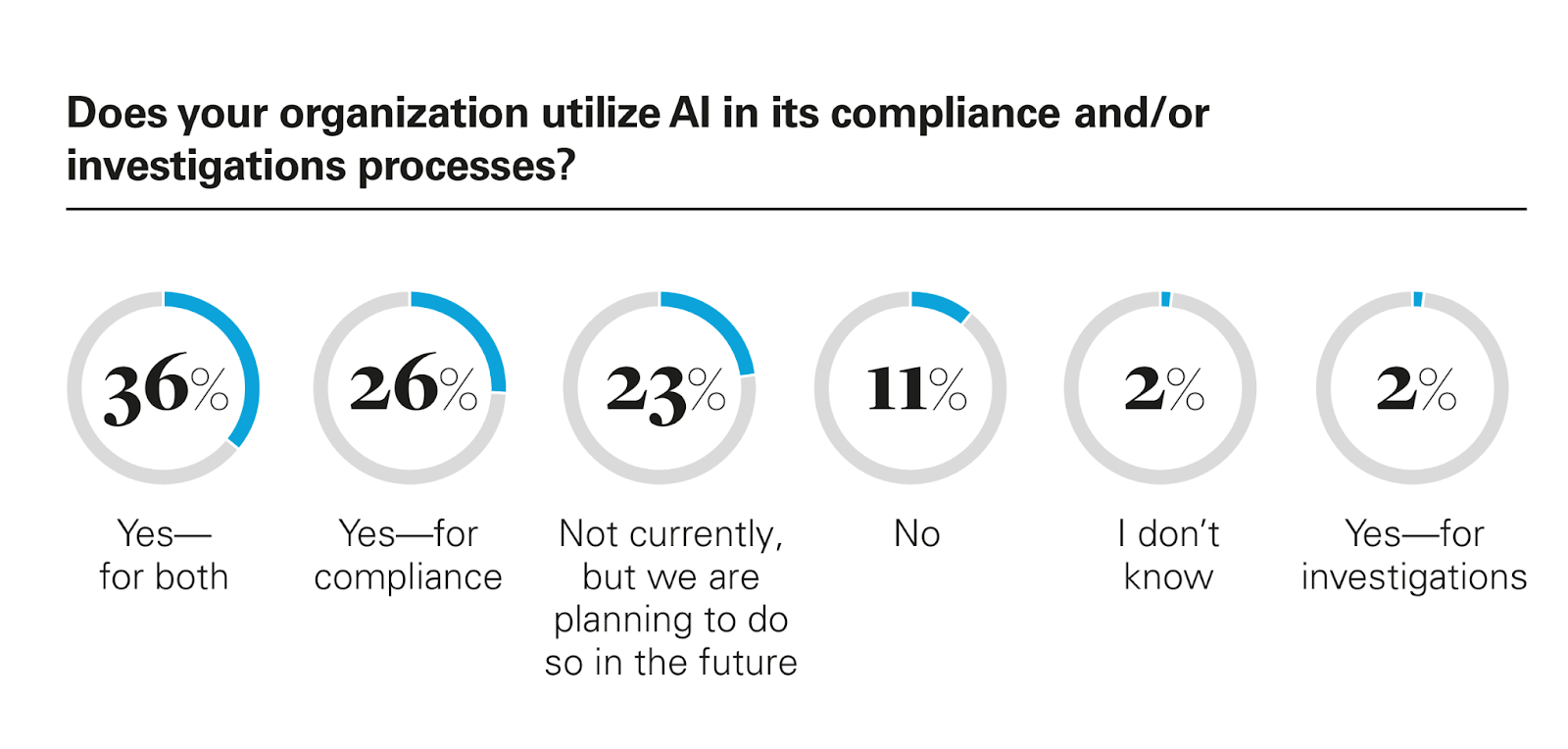

Despite investments in technology and process improvements, the traditional approaches to GRC in many organizations still largely manual and fragmented, leading to inefficiencies and growing operational strain. Industry survey reports claim that a substantial share of companies are still early in their AI journey, using AI mainly for document review and summarization, and experience ongoing challenges with manual compliance tasks. White & Case

(Image Source - White & Chase report - Artificial intelligence in the compliance function)

This points to a broader recognition among compliance professionals that incremental enhancements alone aren’t sufficient to keep pace with regulatory and risk pressures.

Taken together, these forces point to a structural shift in how governance, risk, and compliance are being practiced and supported by technology. What was previously treated as gradual evolution is now manifesting as a change in underlying assumptions about how compliance can—and must—operate.

AI capabilities are increasingly able to support deeper analytical and interpretive work; regulatory obligations continue to expand in scale and complexity; and organizations are becoming more aware of the limits of incremental tooling improvements in meeting these demands.

Where Current Approaches Fall Short

Despite meaningful progress in GRC tooling, several structural limitations continue to constrain how effectively compliance can be managed.

Emphasis on task automation rather than contextual understanding

Many platforms focus on automating discrete activities such as evidence collection, workflow routing, or control attestations. While these capabilities improve efficiency, they often stop short of capturing the underlying context, why specific evidence matters, what regulatory intent it satisfies, where material gaps exist, and how changes in one control area affect overall compliance posture.

Leading GRC bodies stress that mature programs measure risk and requirement coverage, operating effectiveness, and responsiveness, not just the volume of controls tested or issues closed, underscoring how activity metrics can mask gaps in real audit readiness.

Design centered on compliance teams rather than the broader organization

Compliance execution increasingly depends on engineers, security teams, product owners, and operations staff. Yet regulatory interpretation and translation frequently remain concentrated within compliance functions, creating friction and dependency across the organization. When systems fail to bridge regulatory language and operational requirements, compliance continues to rely on manual explanation rather than embedded understanding.

Treatment of regulatory requirements as largely static.

Regulatory frameworks are evolving through frequent updates, interpretive guidance, and consultation cycles rather than infrequent, discrete revisions. Approaches built around periodic remapping and static control matrices struggle to keep pace with this velocity, introducing delays between regulatory change and operational alignment.

Reliance on activity metrics rather than true readiness.

Control completion rates and progress dashboards offer limited insight into audit outcomes. Readiness depends on evidence quality, control effectiveness, consistency over time, and the materiality of gaps, factors that are not fully captured by surface-level activity

What Organizations Should Now Expect from GRC Platforms

“When organizations operate across multiple regulatory and governance frameworks, including values-based standards, compliance systems need to reconcile with regulatory intent.” — Valera Oleksiienko, CTO, Blade Labs

As the structural pressures on compliance continue to intensify, expectations of GRC platforms are shifting. The question is no longer whether tools can support compliance workflows, but whether they can operate at the level of regulatory complexity, velocity, and accountability now required.

Several capabilities are increasingly emerging as baseline requirements rather than differentiators.

Context-Aware Regulatory Intelligence

Modern GRC platforms are expected to ingest regulatory updates as they are issued, interpret them in context, and relate them to existing control environments with minimal manual intervention. This includes maintaining alignment as regulations evolve over time.

In environments such as Islamic finance, where institutions must simultaneously comply with conventional regulatory frameworks and Shariah governance standards (including AAOIFI, IFSB, and internal Shariah board rulings), the ability to interpret and reconcile overlapping obligations is particularly critical. Manual interpretation alone does not scale across jurisdictions, products, or evolving scholarly guidance.

Continuous Compliance as an Operating Model

Compliance posture is no longer static or periodic. Control effectiveness, evidence quality, and risk exposure can change daily as systems, vendors, and operations evolve.

GRC platforms are therefore increasingly expected to support continuous compliance, through ongoing evidence validation, control monitoring, and real-time visibility, rather than relying on point-in-time assessments tied to audit cycles. In regulated financial institutions, this shift is central to moving from reactive audit preparation toward sustained regulatory readiness.

Cross-Framework and Cross-Domain Intelligence

As organizations operate under multiple regulatory regimes simultaneously, GRC systems are expected to recognize where controls, evidence, and processes satisfy overlapping requirements across frameworks.

This extends beyond conventional standards such as SOC 2, ISO 27001, or PCI DSS, to domain-specific overlays. In Islamic finance, for example, a single operational control may need to support prudential regulation, cybersecurity requirements, and Shariah compliance objectives, each with distinct but interrelated expectations. Effective platforms surface these relationships automatically rather than relying on manual tagging or duplication.

Audit-Ready Evidence as a Byproduct of Operations

Evidence management is increasingly expected to be a continuous outcome of normal operations, not a separate pre-audit exercise. Controls, artifacts, and attestations should be collected, validated, and mapped to specific requirements as they are generated.

This is particularly relevant in environments subject to dual assurance, such as external auditors and Shariah supervisory boards, where traceability, consistency, and historical integrity of evidence are essential for defensibility.

Explainability and Traceability of System Decisions

As GRC platforms incorporate more advanced analytics and AI-assisted reasoning, transparency becomes essential. When a system identifies a gap, flags a risk, or suggests alignment with a regulatory requirement, users must be able to understand the rationale behind that conclusion.

This includes visibility into which regulatory sources were applied, how evidence was evaluated, and what assumptions were made. In regulated and Shariah-governed contexts alike, explainability is not optional—it underpins accountability, trust, and regulatory confidence.

Implications for Platform Evaluation

For organizations assessing GRC platforms, this shift suggests a change in evaluation focus:

- Assess platforms using your actual regulatory and governance requirements, rather than pre-configured sample frameworks

- Examine how regulatory updates are incorporated and maintained over time

- Evaluate whether cross-framework relationships are inferred through understanding or maintained manually

- Test whether system outputs can be clearly explained, reviewed, and defended

- Distinguish between platforms that support continuous compliance and those optimized for audit-period reporting

The traditional GRC market that was designed for a different operating reality is evolving. As regulatory expectations expand and compliance models mature, particularly in complex, values-driven environments such as Islamic finance, the gap between incremental optimization and structural capability is becoming more visible.

The organizations best positioned for this shift will be those that recognize the change early and align their compliance infrastructure accordingly.