Issue 6: Special Edition | Blade Labs Year in Review 2024-2025

Translating Vision into Institutional Reality

From Launch to Proof - Our Story of Execution

Singapore FinTech Festival 2024 — A Defining Milestone

At Singapore FinTech Festival 2024, Blade Labs launched what was recognized as the world’s premier embedded Islamic digital finance platform.

The launch articulated a clear position: Islamic finance should not operate as a parallel or peripheral system, but as infrastructure embedded directly into digital workflows, designed for automation, transparency, and enterprise-grade governance.

This milestone marked the point at which our approach to ethical and Shariah-aligned finance was presented publicly, setting the foundation for the validation, recognition, and institutional execution that followed.

FINOPITCH Japan - Global Validation of Our ESG Islamic Finance Platform

In March 2025, Blade Labs received international recognition at FINOPITCH 2025 in Tokyo, winning the Grand Prize in the International category for its ESG Islamic Finance Platform.

The award acknowledged Blade Labs’ work in combining Islamic finance principles, ESG considerations, and AI-enabled governance infrastructure into a single, operable platform - designed to address real regulatory and operational frictions in modern finance.

🔗 FINOLAB official announcement: https://finolab.tokyo/topics/the-final-winners-announced-for-fintech-startup-pitch-contest-finopitch-2025/

This milestone marked a significant point of global validation, demonstrating that an infrastructure-led, ESG-aligned Islamic finance platform can resonate across innovation ecosystems well beyond its core markets.

Trust Through Recognition and Shariah Validation

By April 2025, the conversation around Blade Labs had matured. At the Islamic FinTech Awards in Dubai organized by the AlHuda Centre of Islamic Banking and Economics (CIBE), we were recognized as Best Islamic FinTech Startup.

The recognition reflected growing confidence in our governance-first approach and the operational depth of our platforms, particularly our focus on embedding Shariah compliance, transparency, and accountability directly into financial workflows rather than treating them as post-facto controls.

🔗 Award press release: https://alhudacibe.com/pressrelease245.php

This recognition was followed, in May 2025, by formal Shariah validation of our platform architecture by Amanie Advisors, a globally recognized Shariah advisory firm.

Rather than being treated as a checkbox exercise, the validation was supported by transparent and publicly accessible documentation detailing the governance logic, contractual structures, and compliance reasoning underpinning our systems, reflecting our commitment to operationalizing Shariah principles with clarity and accountability.

🔗 Shariah validation & governance documentation: https://trust.bladelabs.io/

Together, these milestones reinforced a critical point: AI-driven workflows, automation, and continuous compliance can uphold Shariah principles when designed with clarity, intent, and accountability.

Articulating Shariah-Validated Infrastructure for the Next Phase of Islamic Finance

With formal Shariah validation in place, our focus shifted decisively toward real-world engagement with the Islamic finance ecosystem. We participated in the 4th MENA InsurTech Summit in Doha in May 2025, engaging directly with industry leaders from across the region.

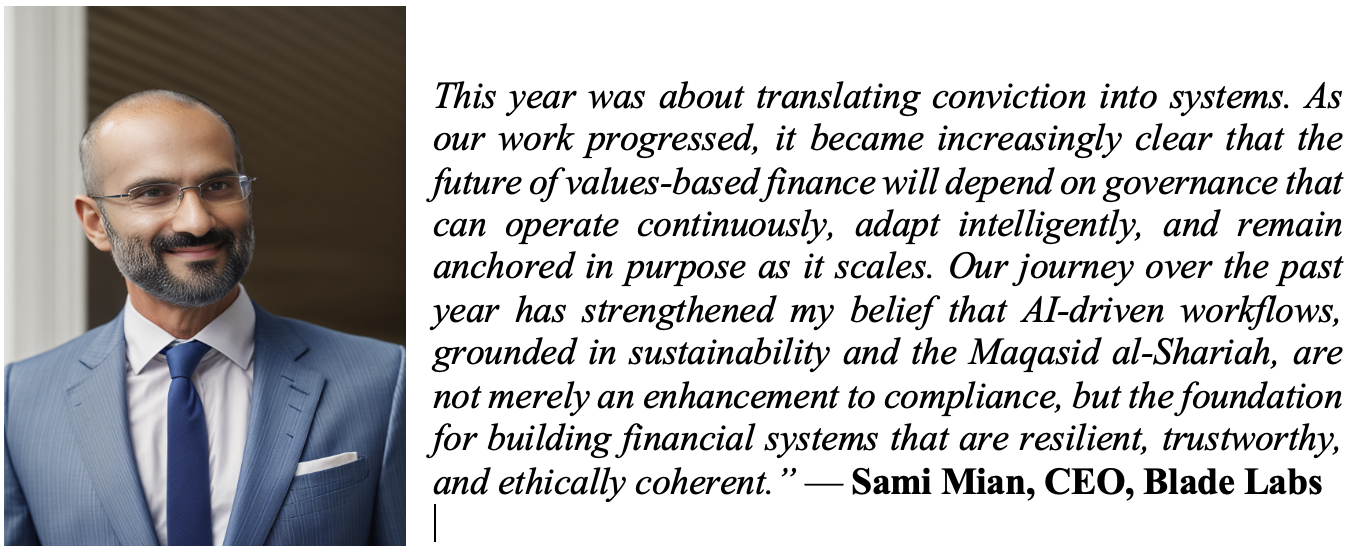

Our CEO, Sami Mian, shared perspectives on “Beyond Currency: The Future of Money and Digital Assets,” exploring how purpose-built infrastructure, using blockchain and AI can address long-standing inefficiencies in Islamic finance and takaful operations. The discussion reinforced a recurring theme: that meaningful innovation in ethical finance must be rooted in systems designed for governance, not retrofitted compliance.

At our booth, we had in-depth conversations with takaful operators, Islamic banks, and fintech builders on how ZeroH, our AI-powered, fatwa-approved GRC platform, can streamline Shariah compliance while reducing friction.

This engagement underscored a clear signal from the market: the future of Islamic finance and takaful lies in technology that respects and enhances Shariah principles from the ground up, rather than treating compliance as an afterthought.

Rethinking GRC - When Technology Meets Regulatory Reality

As engagement across markets intensified, a recurring constraint became clear: traditional, rule-based GRC systems were struggling to keep pace with regulatory complexity and cross-jurisdictional expectations. This insight is well articulated in our recent ZeroH thought-leadership piece, “Rethinking GRC for a Changing Regulatory Reality,” which argues for governance systems that are intent-aware, adaptive, and continuously operating.

🔗 Read the blog: https://blog.zeroh.io/rethinking-grc-for-a-changing-regulatory-reality/?ref=where-islamic-financial-theory-meets-real-world-implementation-newsletter

At this stage of the journey, the technical implications of that shift became unavoidable.

Institutional Proof Through Regulated Deployment

By September 2025, Blade Labs had made a decisive shift from validation to institutional execution. Under the QFC Digital Assets Lab, we partnered with the Qatar Financial Centre, AlRayan Bank, and Hashgraph to deliver a blockchain-based Proof of Concept (POC) for a Digital Receipt System.

🔗 QFC official press release: https://www.qfc.qa/en/media-centre/news/list/qfc-digital-assets-lab-launches-blockchain-based-poc-to-advance-innovation-in-islamic-finance

The POC demonstrates how distributed ledger technology and automated governance layers can materially reduce operational friction, improve traceability, and enhance trust within regulated financial environments, moving from theory into applied infrastructure.

Advancing the AI & Islamic Finance Dialogue in Malaysia

In October 2025, Blade Labs engaged with regulators, financial institutions, and ecosystem leaders at the Global Islamic Finance Forum (GIFF 2025) in Kuala Lumpur. The forum focused on the transformative role of artificial intelligence in Islamic finance, particularly in governance, sustainability, and regulatory readiness.

Being present on the ground in Malaysia, these discussions reflected a clear shift in market maturity.

Institutional Visibility Across Qatar’s Innovation Platforms

As the year drew to a close, our engagement with Qatar’s innovation ecosystem deepened across multiple platforms.

In November, we participated in ROWAD 2025, Qatar Development Bank’s (QDB) flagship entrepreneurship and innovation event, where we engaged with founders, policymakers, and ecosystem leaders shaping the next generation of technology-enabled enterprises in the region. ROWAD reinforced the importance of grounding innovation in practical, locally relevant use cases while remaining globally competitive.

Building on this momentum, we were nominated by QDB to participate in the QDB Pavilion at 4YFN @ MWC Doha 2025 the same month. This nomination positioned us among a curated set of startups representing Qatar’s innovation ecosystem on a global-facing platform.

During MWC Doha, our CEO Sami Mian shared reflections on our journey, from early work on digital wallets and value transfer to tackling deeper friction points in finance through blockchain, AI, and governance-first design, and why Islamic finance, by definition, fair finance, requires systems built for accountability.

🎥 Watch the video featured by QDB: https://www.linkedin.com/feed/update/urn:li:activity:7398600357632950272/

Trust, Assurance & Institutional Readiness

Throughout 2025, we strengthened our institutional readiness alongside external milestones. We completed a SOC 2 Type II audit as well as the ISO/IEC 27001:2022 audit, reinforcing our commitment to enterprise-grade security, risk management, and governance practices.

These milestones reflect our focus on building infrastructure that is not only innovative but robust, auditable, and aligned with the expectations of regulated institutions and global partners.

Looking Ahead: Applying Infrastructure Where Impact Matters

With these foundations in place, we are entering the next phase of our journey with a clear focus: applying AI-native governance and Shariah-aligned infrastructure to real-economy use cases where impact matters most.

As we move into 2026, our work will increasingly explore how compliant, transparent financial infrastructure can support inclusive and asset-backed initiatives, including projects designed to strengthen livelihoods and resilience in underserved communities, while maintaining the same standards of governance, accountability, and institutional readiness that defined the year behind us.

Closing Reflections and Next Steps

As we reflect on the year, one principle stands clear:Ethical and Islamic finance requires infrastructure capable of executing intent consistently and transparently.

Over the past year, we have focused on building and validating that infrastructure. As part of this effort, we have updated our digital presence to make our work more accessible and transparent, and we invite you to explore it firsthand.

To continue the conversation:

- 🌐 Visit our website: https://bladelabs.io/

- 🤝 Connect with our team to explore collaboration

- 🧪 Experience ZeroH, our AI-powered, Shariah-validated GRC platform, and explore our platform at: https://zeroh.io/

- ✍️ Subscribe to our thought leadership on AI, governance, and ethical finance: https://blog.zeroh.io/

Thank you for being part of this journey.

— Team Blade Labs