Issue 5 : Rewriting the Compliance Playbook: GRC Automation for Islamic Finance

Special Announcement 📣Introducing Mr. Lim Say Cheong

Senior Board Advisor,

Blade Labs

We are honoured to welcome Mr. Lim Say Cheong as a Senior Board Advisor to Blade Labs. His reputation, integrity, and decades of contribution to the Islamic finance industry make this a particularly meaningful addition to our journey.

Mr. Lim brings over 20 years of leadership across Islamic banking, capital markets, private equity, venture capital, funds, and takaful. A Malaysian-born professional with an academic foundation in Mathematics and Econometrics from the University of Sydney, he later completed an Executive MBA at INSEAD France, strengthening his global perspective and strategic leadership capabilities. His career reflects a rare combination of technical depth, strategic foresight, and cross-market experience.

He began his career with a decade at Bank of America in Singapore, rising to Treasurer, followed by seven years in senior roles within Malaysian retail banking. In 2006, he transitioned into Islamic finance with Noor Islamic Bank in Dubai, before moving to Al Hilal Bank, a fully fledged Islamic bank owned by the Abu Dhabi Investment Council, as Head of Investment Banking. Under his leadership, the team executed over 50 Sukuk transactions across sovereign, financial institution, and corporate issuances, earning the bank a consistent top-five global ranking in Islamic capital markets.

His subsequent roles include senior leadership at Nomura (Global Head of Distribution) and CEO of Lootah Global Capital, a DIFC-licensed financial services firm, before taking up his current role at a leading Saudi venture capital company in Riyadh. In recognition of his contributions to the global Islamic finance landscape, Mr. Lim received the Cambridge Islamic Finance Leadership Award in 2022, further underscoring his status as a thought leader in the industry.

Mr. Lim is also the recipient of the prestigious Chevening-Oxford Centre for Islamic Studies Fellowship, currently in residence at Oxford. His research focuses on AI-enabled governance frameworks for Shariah compliance, an area closely aligned with Blade Labs’ mission of building digital-native Islamic finance infrastructure.

Beyond the private sector, he has served as an advisor to multiple sovereigns on Sukuk issuance, including Kazakhstan, Côte d’Ivoire, Maldives, Hong Kong, Turkey, Saudi Arabia, and Indonesia, supporting governments in developing robust, Shariah-compliant capital market frameworks.

Mr. Lim’s breadth of experience, rigorous understanding of Islamic financial structures, and forward-looking research make him an invaluable partner as we continue expanding into the next phase of purpose-built, technology-driven Islamic finance.

We extend a warm welcome and look forward to the strategic insight he will bring to Blade Labs.

Strengthening Governance Through GRC Automation

Governance, Risk, and Compliance (GRC) automation is reshaping how institutions navigate increasingly complex regulatory environments. As global standards tighten and cross-border operations expand, automation is emerging as a strategic advantage, improving accuracy, strengthening governance, and enabling transparent, defensible compliance.

Industry trends reflect this acceleration:

- The global GRC market is expected to grow from USD 49 billion in 2024 to USD 127.7 billion by 2033.

- The Banking, Financial Services, and Insurance (BFSI) sector accounts for over 20% of global GRC spend.

- Cloud-based GRC platforms continue to lead adoption due to scalability and lower deployment costs.

- AI-enhanced platforms are improving fraud detection, predictive risk modelling, and evidence management.

What automation delivers:

- Fewer manual tasks and higher operational accuracy

- Greater transparency, auditability, and reporting efficiency

- Stronger governance with the agility needed for modern compliance demands

GRC Automation in Islamic Finance

Addressing Unique Challenges with Digital Infrastructure

Islamic finance requires not only financial integrity but operational integrity: the ability to enforce Shariah requirements consistently, traceably, and across diverse jurisdictions. This is where GRC automation plays a transformative role.

Current industry pain points include:

- Shariah non-compliance risks, often worsened by uneven regulatory enforcement

- Inconsistent standards across markets, slowing cross-border scalability

- Manual Shariah audits and fragmented documentation trails

- Lack of specialized technology infrastructure to operationalize Shariah rules

- High operational cost of manual verification, especially in Murabahah workflows

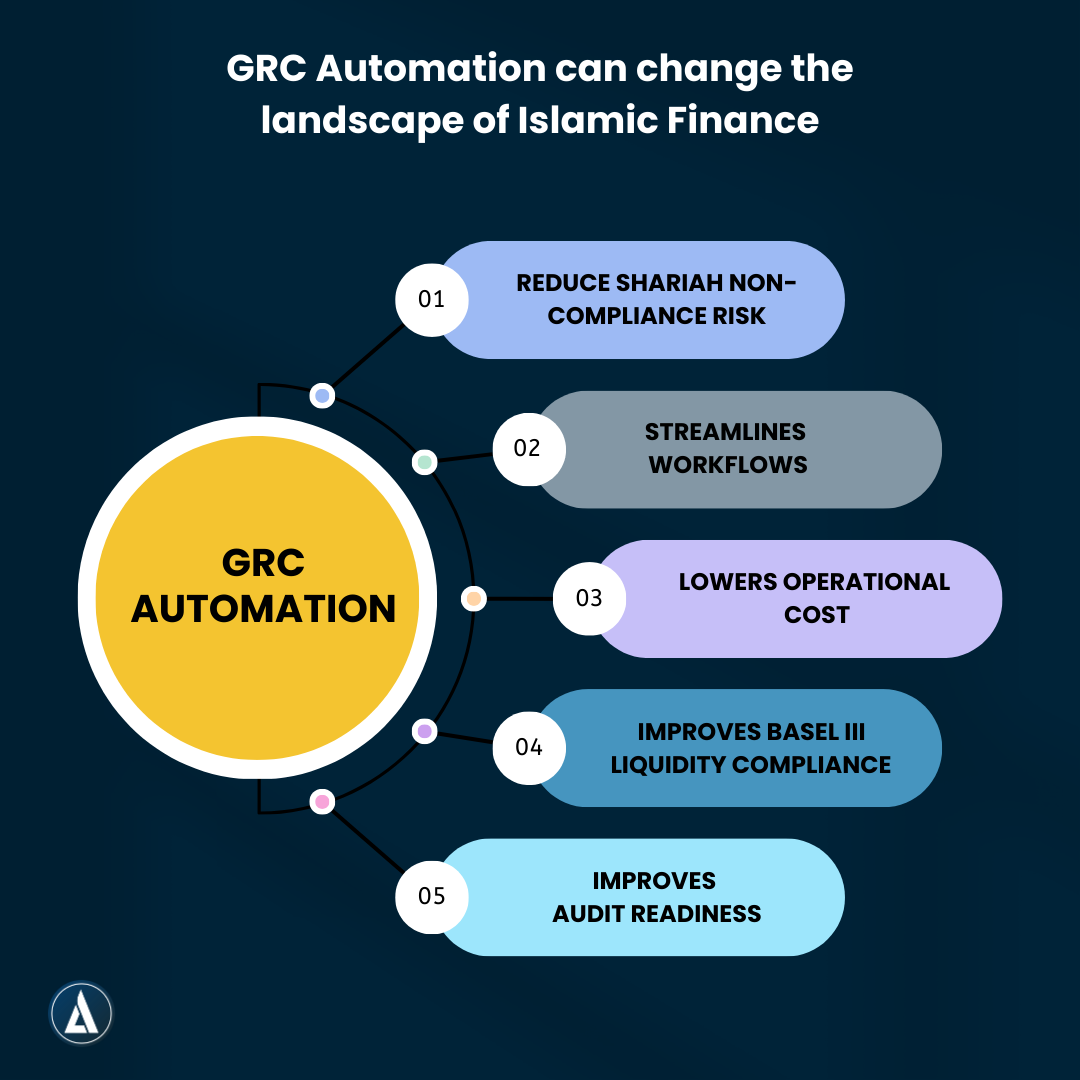

How GRC automation changes the landscape:

- Automates compliance checks to reduce Shariah non-compliance risk

- Streamlines workflow documentation and decision trails

- Lowers operational cost by reducing manual verification steps

- Improves Basel III liquidity compliance processes and reporting.

- Improves audit readiness and governance defensibility

Importantly, automation does not replace human oversight or Shariah judgment. Instead, it ensures that once decisions are made, they are implemented consistently, transparently, and in full alignment with institutional policy and regulatory expectations.

Read More: Why Authentic Islamic Finance Should Be Faster, and Can Be

Our latest article explores why Islamic finance, despite its strong ethical and contractual foundations, often experiences slower product execution. It highlights that the challenge lies not in Shariah principles themselves, but in the manual, document-heavy workflows that govern how those principles are operationalised.

The piece explains how modernizing governance and digitizing compliance workflows can unlock significant speed, transparency, and scalability, without compromising authenticity.

Key Takeaways:

- The bottleneck is structural, not theoretical: Islamic finance slows down due to manual workflows and fragmented governance, not because of Shariah principles.

- Documentation overload is the hidden cost: Excessive reliance on paper-based reviews and repeated approvals creates avoidable delays and operational friction.

- Digital-native GRC automation is the unlock: Machine-readable policies and automated evidence trails can dramatically accelerate product delivery while enhancing compliance integrity.

Thank you for joining us in shaping a more efficient, transparent, and resilient future for Islamic finance. With the power of GRC automation and the guidance of visionary leaders like Mr. Lim Say Cheong, Blade Labs is committed to building the digital infrastructure that enables institutions to scale with confidence.

Together, we are laying the foundation for the next generation of Islamic finance, grounded in strong governance and empowered by technology.