Issue 4 : Special Edition Newsletter | GIFF 2025 Malaysia

Where values meet innovation: AI for capacity building in Islamic finance

“At Blade Labs, we’re pioneering AI that reasons with Hikmah and upholds Maqasid al-Shariah, embedding wisdom into digital infrastructure so Islamic finance can stay true to its principles while meeting the needs of people, families, and communities” — Sami Mian, CEO, Blade Labs

Beyond Adoption: The Next Question for Islamic Finance

The Islamic finance industry today stands at an inflection point. Valued at over $5 trillion globally, it has earned its reputation for resilience by grounding financial activity in ethics, transparency, and human-centered commerce. Its governance structures, rooted in Shariah principles, have enabled stability through cycles that have tested conventional systems.

But as the world accelerates into the digital economy, the challenge is no longer about proving resilience; it is about scaling it. Manual compliance processes, paper-heavy verification, and siloed operations cannot keep pace with the growing demands of markets, regulators, and customers. If Islamic finance is to remain globally competitive, it must embrace tools that allow it to expand without diluting its principles.

This is why the central question is no longer: “Can Islamic finance adopt AI?”

It has become: “How can AI serve the higher objectives of Shariah while building genuine institutional capacity?”

The Conversation at GIFFKL 2025

At GIFF 2025 in Kuala Lumpur, our CEO Sami Mian will join industry leaders to discuss:

🎙️ “Revolutionising Islamic Finance – The Transformative Role of Artificial Intelligence.”

Meet Us in Malaysia | October 13 – 15, 2025

Blade Labs @ Global Islamic Finance Forum (GIFF) 2025

For Blade Labs, the transformative role of AI is not in replacing governance but in enhancing it. Our approach focuses on:

- Hikmah-driven AI — systems that reason with wisdom, not just replicate checklists.

- Capacity building — enabling institutions to scale Shariah-compliant products without proportionally scaling compliance overhead.

- Inclusion by design — using AI and digital identity infrastructure to extend access to underserved markets responsibly.

This is the conversation we are bringing to Kuala Lumpur — how Islamic finance can lead globally by showing that technology, guided by values, drives human flourishing.

The Blade Vision: Building the Foundations of Trust

Scaling Islamic finance in the digital era requires infrastructure that is both technically robust and philosophically aligned. At Blade Labs, we’re designing that foundation — embedding Shariah objectives directly into the transaction layer itself.

From real-time digital receipts that can transform audit cycles, to livestock financing infrastructure that brings transparency to underserved markets, to smart contract logic that automates sequencing in Murabaha and Musharakah — each initiative shares a common purpose:

Capacity building, not just compliance.

We’ve outlined this vision in detail in our latest article, exploring how AI and digital identity can enable authentic scale in Islamic finance: 📖 AI for Capacity Building in Islamic Finance — The Blade Labs Vision

Malaysia’s Moment: Leading the Next Wave

"Malaysia has long been at the forefront of Islamic finance innovation, combining strong Shariah governance with a progressive regulatory mindset. For Blade Labs, it represents a partner ecosystem where AI-driven infrastructure can be tested, scaled, and refined in alignment with global Islamic finance ambitions." — Intesar Haquani, CBO, Blade Labs

Malaysia’s Islamic finance ecosystem continues to serve as a global benchmark for responsible innovation. For Blade Labs, Malaysia represents a natural environment for advancing AI-driven capacity building.

Why Malaysia:

- Bank Negara Malaysia’s emphasis on operational efficiency aligns with Blade Labs’ capacity-building approach.

- FIKRA’s Islamic fintech accelerator provides a platform for concept validation and regulatory engagement.

- The livestock and asset-based financing sectors present immediate applications for our digital financing infrastructure.

- Malaysia’s leadership in Shariah governance standards offers an ideal environment for testing Maqasid-aligned AI frameworks.

With GIFF 2025 bringing together policymakers, scholars, and innovators, Malaysia is poised to lead the next chapter of Islamic finance where technology strengthens rather than supplants ethical governance.

At Blade Labs, our commitment is simple: to ensure that AI in Islamic finance doesn’t just work faster, it works wiser.

Global Perspectives: Insights from Industry Report

The conversation around AI in Islamic finance is not happening in isolation. Financial institutions and enterprises are already highlighting the opportunity for AI to expand financial access through alternative data, public records, and predictive analytics, particularly for underserved communities.

Read this insightful report by IsDB - ARTIFICIAL INTELLIGENCE AND ISLAMIC FINANCE: A Catalyst for Financial Inclusion

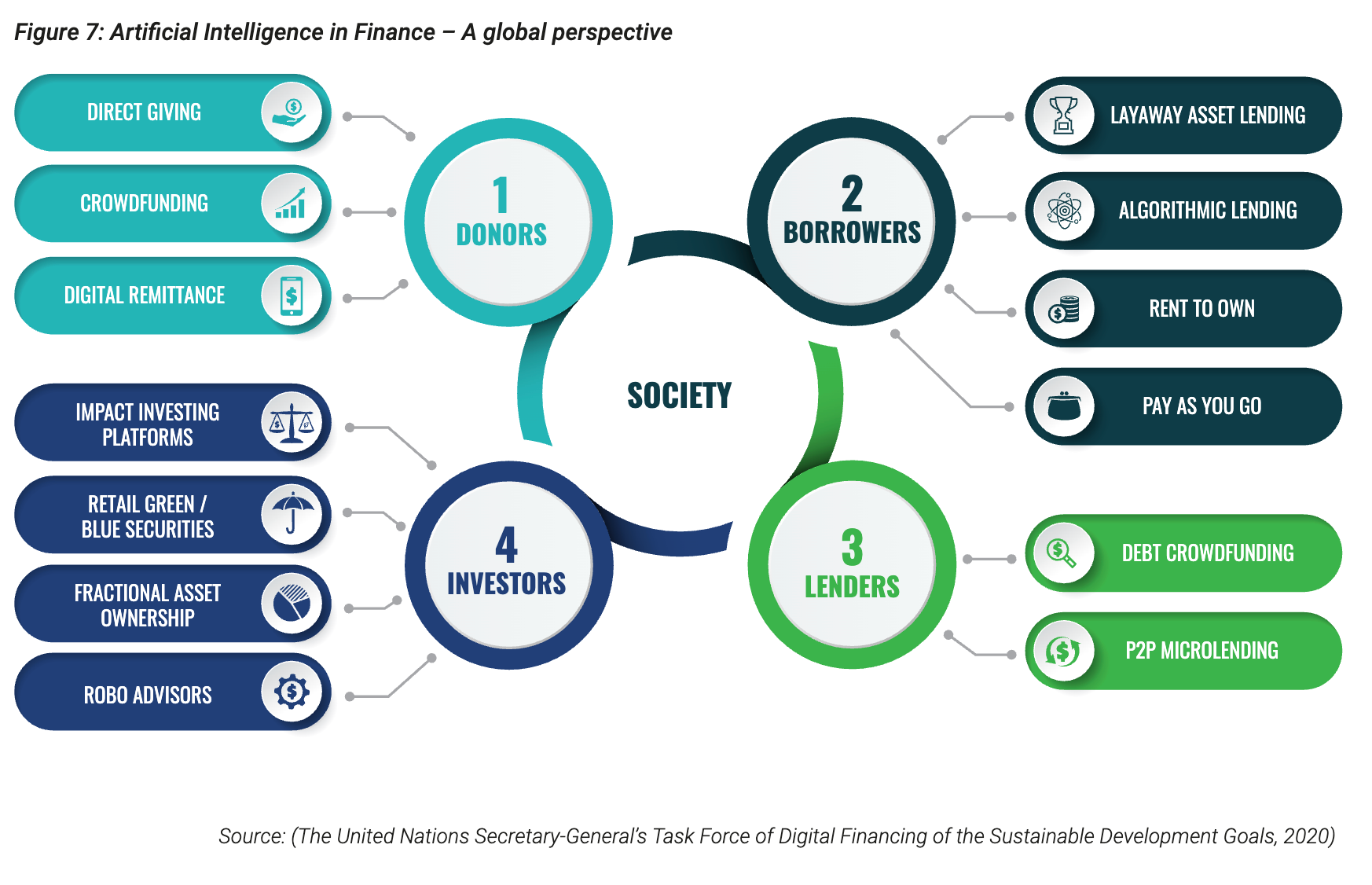

The report illustrates how AI is transforming financial participation across society — from donors using digital remittances, to borrowers accessing algorithmic lending, to investors leveraging robo-advisors. This broad ecosystem perspective underscores that AI is not a single-tool innovation, but a catalyst for reshaping financial systems end-to-end.

At Blade Labs, we build on this foundation by embedding Maqasid al-Shariah directly into digital infrastructure. Where global reports identify AI’s potential for financial inclusion, our work focuses on turning that potential into practical, scalable systems that uphold Shariah, enable transparency, and strengthen trust.

As GIFF 2025 brings together regulators, scholars, and innovators in Kuala Lumpur, the convergence of these global perspectives with local leadership makes Malaysia the ideal place to shape the next chapter of AI in Islamic finance.

See you at GIFF 2025: where technology, guided by values, builds the next chapter of Islamic finance.