Issue 3 : Strengthening Islamic Finance Infrastructure: Insights from Qatar, Next Steps in Malaysia

Major Milestone: Blade Labs’ Digital Receipt System Featured in Qatar’s Digital Asset Lab

Earlier this month, Qatar Financial Centre’s Digital Asset Lab announced the launch of a blockchain-based proof-of-concept that incorporates Blade Labs’ Digital Receipt System (DRS), developed in collaboration with AlRayan Bank and Hashgraph.

The initiative is supported by Qatar Development Bank (QDB) and marks the first government-backed digital Islamic infrastructure project in the GCC. For Blade Labs, this represents an opportunity to demonstrate how our infrastructure can address specific operational challenges in Islamic finance within a regulated environment.

Key areas of validation for Blade Labs:

- Institutional: Recognition through QDB portfolio status and QFC’s regulatory sandbox framework

- Banking: Real-world testing with AlRayan Bank on Islamic banking operations

- Technical: Six-month proof-of-concept validating the ability to digitize asset ownership and compliance processes

- Strategic: Creates a foundation for Blade Labs to expand Islamic fintech infrastructure across the region

🗞️ Read the full announcement in the official QFC press release

Building the Digital Receipt System for Islamic Finance 🕌

What does it mean to digitize Islamic finance?

At Blade Labs, we're building a blockchain-based Digital Receipt System within QFC's Digital Asset Lab that creates immutable, real-time proof of ownership for Islamic finance transactions.

Our platform combines:

• HashSphere network for <2 second transaction processing

• W3C DID/VC standards for privacy-preserving verification

• Digital twin asset management for complete lifecycle tracking

• Triple-ledger accounting for cryptographic integrity

Every digital receipt serves as cryptographic evidence of asset ownership states, Sharia compliance verification, and proper transaction sequencing - giving customers immediate, verifiable proof of their financial rights.

This is standards-first digitization - building compliance before proprietary features, ensuring legal equivalence with MLETR alignment and Qatar Digital Asset Regulation compliance.

⛓️💥 Digital Receipts on Blockchain: A Proof of Concept for Islamic Finance

To explore the foundational ideas behind our approach, we invite you to read our blog post on digital receipts in Islamic finance, which outlines the rationale and mechanics underlying our proof-of-concept.

Our Digital Receipt System (DRS) creates blockchain-based digital certificates throughout Islamic finance transactions, addressing three key operational challenges.

How It Works: DRS generates time-stamped digital receipts that confirm the bank’s asset ownership, automate parts of Shariah compliance verification, and build immutable audit trails. Each receipt is securely anchored on blockchain, ensuring regulators, banks, and customers can verify ownership and compliance at any point in time.

Important Clarification: This is still a proof-of-concept using simulated data under QFC’s regulatory sandbox. We are testing technical capabilities and assessing business outcomes before any commercial roll-out.

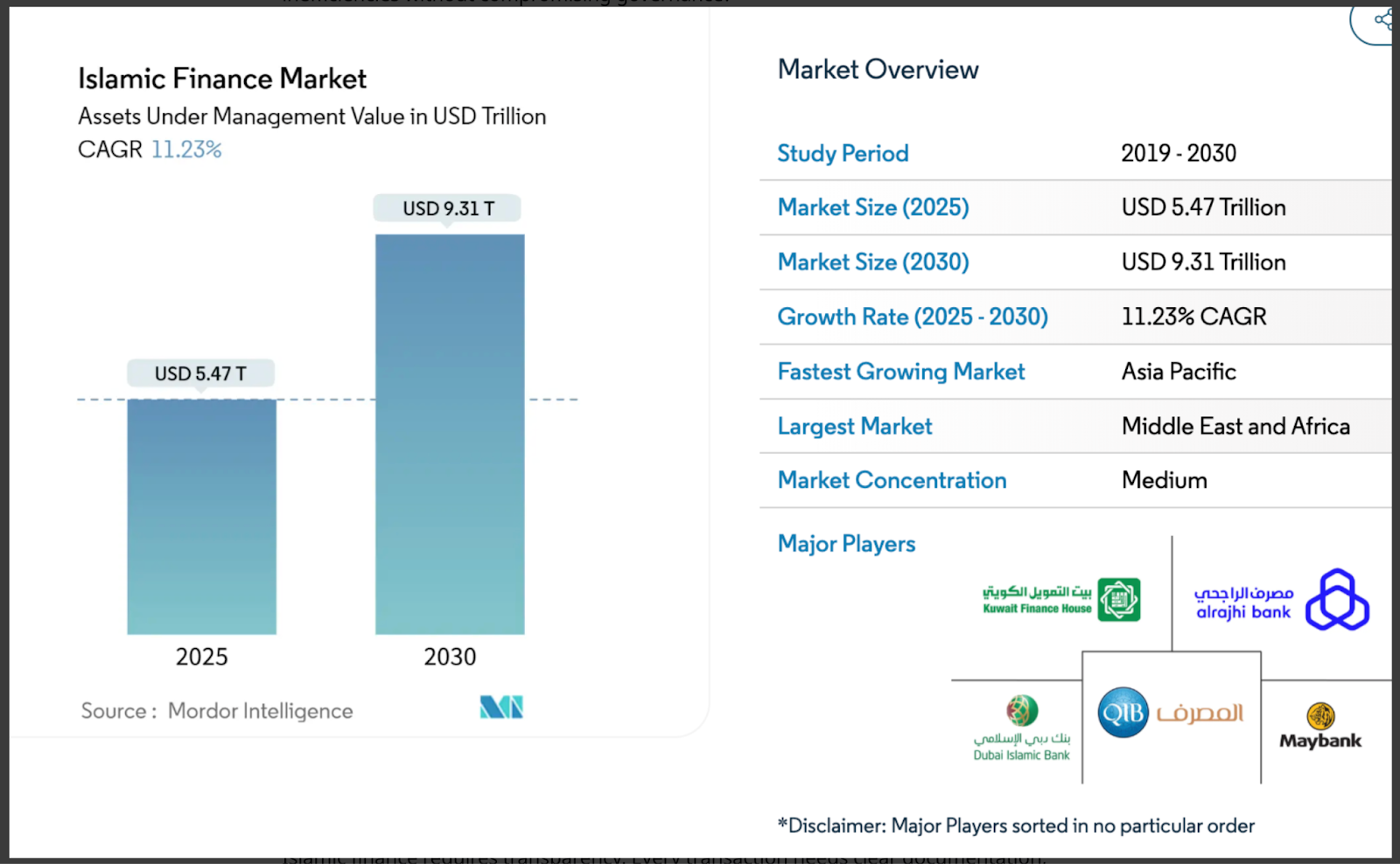

📈 Enhancing Governance in a $5 Trillion Islamic Finance Ecosystem

We believe technology should enhance governance, not displace it.

The Islamic finance industry, currently valued at more than $5 trillion, rests on strong governance, clear documentation, dual approvals, and Shariah oversight. Yet these safeguards often depend on paper-heavy systems that slow down processes, raise costs, and frustrate customers. At Blade Labs, we set out to answer a critical question: can blockchain reduce these inefficiencies without compromising governance?

For a deeper exploration of this principle, see our ✍🏻 blog post on how blockchain strengthens governance.

Next Chapter: GIFF 2025 in Kuala Lumpur

📌 Save the Date: October 13-14, 2025 - Global Islamic Finance Forum at Sasana Kijang, Bank Negara Malaysia.

We'll be participating in this premier Islamic finance gathering to share insights from our Qatar experience and explore strategic opportunities in Malaysia—the world's largest Islamic banking market.

Our GIFF 2025 Focus:

Reflections from Qatar: What the QFC Digital Asset Lab initiative signals for the future of Islamic fintech and regulatory innovation

Technical Capabilities: Ongoing work on the Digital Receipt System and new efforts to build AI-driven solutions tailored for Islamic finance operations

Ecosystem Alignment: How Blade Labs’ infrastructure can complement Malaysia’s regulatory leadership and support market growth

Inclusive Finance & Sustainability: Insights from our Digital Cattle Pilot, highlighting how Islamic finance infrastructure can expand access and support sustainability objectives

Preview: Our next newsletter will provide comprehensive GIFF 2025 coverage, including partnership developments and Malaysia market entry insights.