Has Sustainable Islamic Finance Hit a Governance Ceiling?

Why governance friction, not capital, is becoming the new bottleneck for growth.

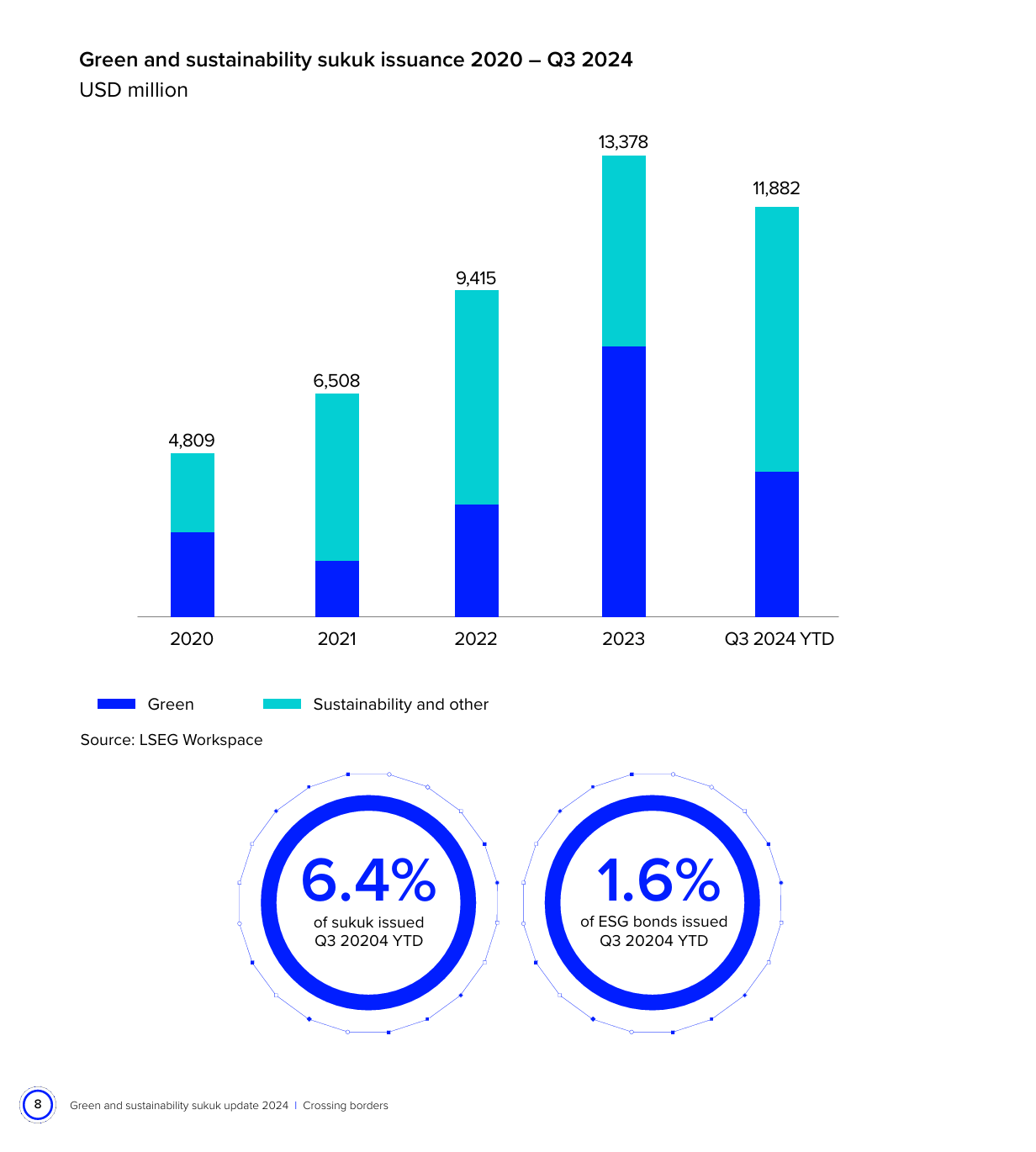

Sustainable Islamic finance hit $11.9 billion in ESG sukuk issuance through Q3 2024, already surpassing 2023’s full-year total. Yet behind this growth lies an uncomfortable paradox: institutions are spending more time proving compliance than creating impact.

(Image Source: GREEN AND SUSTAINABILITY SUKUK UPDATE 2024 - Crossing Borders)

Industry research on Shariah compliance and risk management in Islamic financial institutions highlights that institutions invest significant efforts in adhering to strict Shariah laws and risk controls which directly affect operational efficiency and financial performance. The need to ensure thorough due diligence, compliance checks, and governance creates operational demands that can consume resources and attention that might otherwise be directed toward innovation or direct impact creation.

The Scaling Ceiling

Islamic finance was supposed to be born from principles of transparency, shared risk, and real economic value. It promised to avoid the opacity that brought conventional finance to its knees in 2008. Yet today, Islamic banks issuing sustainable sukuk spend more time reconciling spreadsheets than financing green projects.

The problem isn’t commitment. It’s infrastructure.

Every sustainable issuance now passes through a tangle of overlapping frameworks, for instance - QFC’s digital finance standards, Bank Negara Malaysia’s VBI, EU Taxonomy, CSRD disclosure rules, and Shariah verification. Each layer demands proof, each uses its own reporting cadence and evidence format.

Here’s how that plays out inside an Islamic bank:

- The regulator wants lifecycle documentation in one format.

- The Shariah board reviews contract structures in another.

- The ESG verifier requests the same data, reformatted for ICMA Green Bond Principles.

- The auditor needs an export that reconciles all three.

Then the real pain begins.

In one common scenario, the Shariah board approves a sukuk structure in March using documentation v 2.3. By May, the regulator reviews v 2.7 with three material updates never re-reviewed by Shariah. The ESG verifier assesses v 2.5 in June.

When pre-issuance audit starts, the team spends 11 days reconciling which version is authoritative. This illustrates the predictable result of four frameworks, four evidence standards, and four “sources of truth.”

That’s the scaling ceiling: growth constrained not by lack of capital, but by governance friction.

Why Current Solutions Fail

- Status quo (Email + Spreadsheets) Each framework has different evidence structures. Manual tracking multiplies “truths” until no one knows which record is final. The result: slower issuances, higher audit costs, and hidden non-compliance risk.

- Generic GRC toolsThey manage attestations, not Shariah-linked impact chains. They can’t express a Mudarabah or Sukuk workflow that binds regulatory, ESG, and Shariah logic in one verifiable sequence.

- Custom internal buildsBanks that attempt their own workflow layers quickly hit the need for tamper-evident, cross-institution records, effectively a distributed ledger. Most neither have nor want to maintain that stack.

Hence the core insight:

Checklists fail in Islamic sustainable finance not because people ignore them, but because they multiply sources of truth across frameworks that were never designed to reconcile.

The Missing Layer: Execution Infrastructure for Governance

The real bottleneck therefore is architecture. Islamic financial institutions already know what needs to be reported. They just lack a system that executes governance as it happens, not after the fact.

Current processes collect evidence after each issuance, as if governance were an audit exercise. But governance, by definition, is continuous, a living proof chain that must connect policy, execution, and assurance in real time.

What the industry needs is an execution infrastructure: a platform that turns regulatory, ESG, and Shariah requirements into workflows that generate their own evidence. That’s what “governance as infrastructure” actually means.

What GRC Infrastructure Actually Means

In sustainable Islamic finance, GRC infrastructure has three defining properties:

- Single policy-execution layer — QFC rules, VBI guidance, ESG and Shariah requirements compiled into one executable workflow, not separate spreadsheets.

- Ledger-backed auditability — Every action leaves a time-stamped, tamper-evident trail accessible to all stakeholders.

- Multi-framework reporting from one source of truth — So QFC, VBI, ESG and SDG reports all derive from the same verified record.

That’s what “infrastructure not overhead” really means.

Why This Shift Matters: Islamic Finance's Structural Advantage

ESG reporting is voluntary theater. Companies self-report impact metrics, third-party verifiers check PDFs against other PDFs, and investors hope the numbers are real.

Islamic finance doesn't have that luxury. Shariah compliance mandates what ESG frameworks merely recommend: transparency of capital flows, verification of real economic activity, prohibition of speculation that obscures accountability.

The irony? While conventional finance struggles to retrofit transparency into 200-year-old systems, Islamic finance has the structural advantage, if it stops treating governance as overhead and starts treating it as infrastructure.

It reframes Islamic finance from "catching up" to "leapfrogging," and positions GRC infrastructure as the unlock for a structural competitive advantage.

The Market Implication

The EU’s Corporate Sustainability Reporting Directive (CSRD) will make assured sustainability reporting mandatory for ~50,000 companies. Islamic finance, founded on transparency and shared risk is uniquely positioned to lead this transition.

By adopting shared GRC infrastructure, Islamic institutions can prove compliance, Shariah alignment, and impact in real time—not quarters later through retrospective reports.

This isn't a single-market opportunity. The same infrastructure that enables sustainable Islamic finance can extend to all sustainable finance products globally, and ultimately to any regulatory framework requiring verifiable policy execution.

Conclusion: Infrastructure for Trust

Sustainable Islamic finance has already proven market demand. The next test is execution.

As global finance moves toward mandatory sustainability verification, the EU alone is bringing 50,000 companies under assured reporting. In this new era of transparency, where banking customers demand proof and ESG rating divergence erodes trust, the institutions that can demonstrate verified impact will lead.

Islamic finance holds a distinct advantage: its founding principles already embed the transparency and accountability others are now racing to engineer. The question isn’t whether to embrace that advantage; it’s whether to operationalize it through infrastructure built for proof.

The institutions that treat compliance as shared infrastructure, not a reporting burden, will scale faster, reduce costs, and deliver the transparency their stakeholders increasingly demand.

At Blade Labs we are building the infrastructure that transforms regulatory policies and Shariah principles into executable, verifiable workflows. This policy-to-proof architecture is purpose-built for the multi-framework complexity of sustainable Islamic finance, integrating workflow orchestration, AI-driven policy interpretation, and cryptographic proof generation.

The result is a governance infrastructure where compliance requirements from QFC, VBI, the EU Taxonomy, and Shariah boards are translated into automated, auditable processes. The goal is simple: to make governance automatic and verifiable, not a burden.The market is moving toward verifiable impact. Islamic finance can lead that transition by demonstrating what governance infrastructure looks like when transparency is a principle, not an afterthought.