From Compliance to Capacity: Building the Infrastructure for Ethical Finance

Islamic finance has always been about more than transactions, its a 1,400-year laboratory for ethical finance. The principles that govern Shariah compliance are the same ones conventional finance is now scrambling to implement under ESG mandates.

It is a financial system rooted in values: fairness, transparency, shared risk, and social good. Yet as the industry surpasses USD 5 trillion in global assets, one truth has become evident: its institutional infrastructure has not scaled as quickly as its ambition.

Across the ecosystem, from regulators issuing Value-Based Intermediation (VBI) mandates to banks implementing AAOIFI standards and auditors validating Shariah outcomes, the frameworks for ethical finance are well-established. What’s missing is the machinery to execute them at scale. Policies are issued in months. Implementation takes years. The result is a structural gap between regulatory intent and operational capacity.

At Blade Labs, we see this gap not as a limitation but as an opportunity to build an AI-powered infrastructure layer that enables financial institutions to translate moral and legal frameworks into executable, measurable, and auditable workflows.

AI for Capacity Building: Scaling Principles Without Scaling Complexity

Our journey began with a simple question:

How can we scale the impact of ethical and Shariah-compliant finance without scaling manual oversight?

Today’s compliance and governance systems rely heavily on human coordination - policies move across committees, Shariah boards review documentation, auditors reconcile reports, and regulators await evidence of implementation. The process is rigorous but slow, creating friction in ecosystems that must now demonstrate both performance and purpose.

Our answer was to reimagine AI as infrastructure for capacity building.Not as a front-end application or isolated tool, but as an enabling layer that interprets regulatory language, applies ethical reasoning, and ensures that actions across the ecosystem remain aligned with shared principles.

In practice, this means digitizing trust:

- Turning policies into code.

- Converting oversight into shared intelligence.

- Enabling regulators, financial institutions, and impact platforms to operate on a common, verifiable system of record.

From Automation to Understanding: Embedding Ethical Reasoning in AI

As the technology evolved, so did the philosophy behind it.Automation alone is not enough. The real question is: can AI understand the ethical reasoning behind financial rules?

In Islamic thought, Hikmah (wisdom) represents discernment: the ability to apply knowledge in a way that preserves justice and purpose. Designing AI that reasons through this lens means building systems that don’t just execute rules, but understand why those rules exist and how they relate to the higher objectives of Islamic law (Maqasid al-Shariah): preservation of faith, life, intellect, lineage, and wealth.

This marks a shift from rule-based compliance to objective-based intelligence, from checking boxes to ensuring that outcomes align with purpose.

For institutions, this translates into new possibilities:A Shariah auditor can verify whether a financing structure promotes socio-economic justice; a regulator can observe impact metrics tied to Maqasid objectives; and a bank can demonstrate that its products contribute to shared prosperity, not just procedural compliance.

Operationalizing Policy: The VBI Imperative

The next frontier, and where our focus lies, is automating policy workflows within an impact-based framework.

Malaysia’s Value-Based Intermediation (VBI) initiative, led by Bank Negara Malaysia, provides a global blueprint for how Islamic finance can demonstrate tangible value creation. VBI requires institutions to move beyond compliance and actively measure the outcomes of their operations, including environmental, social, and governance (ESG) impact, aligned with Shariah intent.

The challenge, however, is operational:How can these principles be executed across multiple stakeholders, in real time, with traceable accountability?

That’s where Blade’s infrastructure plays its role.We’re building the connective tissue between policy and execution, systems that automatically interpret regulatory updates, guide institutional workflows, and record compliance data in verifiable, tamper-proof formats.

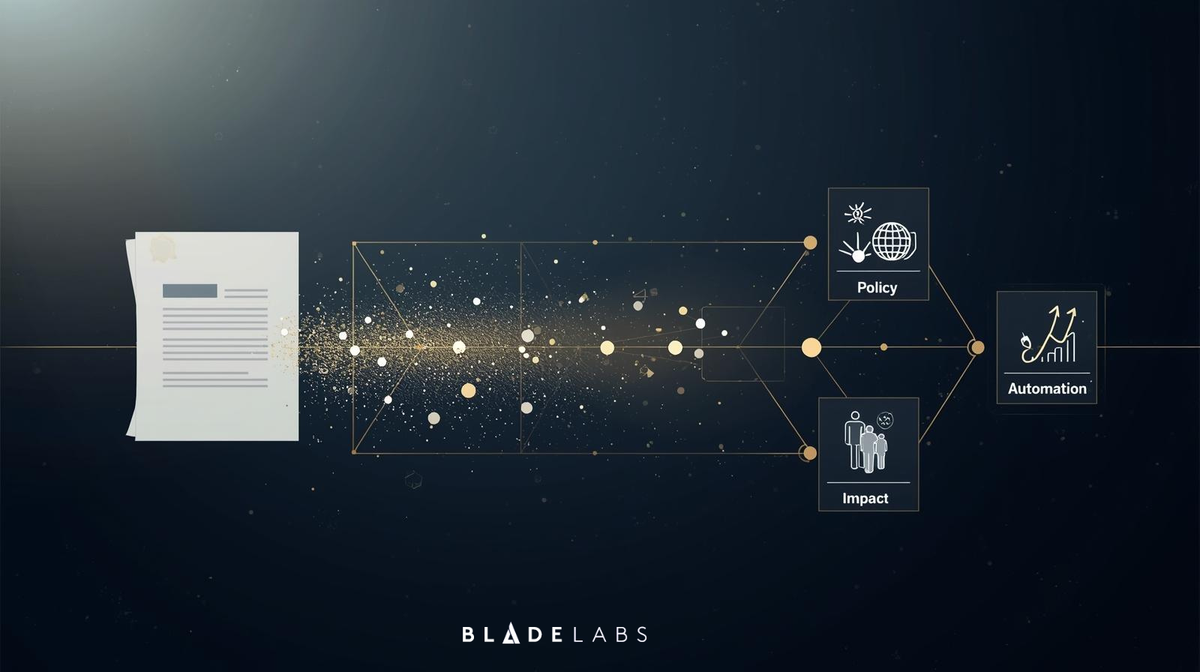

Illustration - Imagine a policy issued under VBI — for example, a new SME financing transparency guideline. Instead of a PDF circulating between departments, it becomes machine-readable logic that institutions can implement instantly:

- AI parses the policy and maps it to applicable workflows.

- Smart contracts enforce reporting and data-sharing requirements.

- Regulators, auditors, and Shariah boards observe outcomes through a shared dashboard.

What once required months of coordination becomes an automated, auditable policy lifecycle — built on the principles of Hikmah and Maqasid, verified through AI and distributed ledger infrastructure.

At the Royal Dinner during GIFF 2025, the Governor of the Central Bank of Malaysia captured this moment perfectly:

"Transformation is not a departure from proven foundations that have served us well. Rather, it is a bold reimagination of what might be possible — a way to deepen our purpose and reaffirm our commitment to the values that define us." - Welcoming remarks by Mr Abdul Rasheed Ghaffour, Governor of the Central Bank of Malaysia (Bank Negara Malaysia)

This is precisely what our infrastructure enables: not replacing the foundations of Islamic finance, but building the machinery that allows those foundations to scale.

Why It Matters: From Frameworks to Measurable Impact

This convergence of AI infrastructure, ethical reasoning, and automated policy execution represents more than a technical milestone. It is the foundation for a new kind of financial ecosystem: one that thinks with integrity and measures with intent.

It also reframes how Islamic and ethical finance can lead in the global sustainability discourse. As research increasingly shows the alignment between UN Sustainable Development Goals (SDGs) and Maqasid al-Shariah, the ability to quantify impact in faith-based finance has become both a moral and market imperative.

VBI provides the policy spine. AI provides the operational brain. Together, they enable Impact as a Service, where every transaction carries built-in verification of its social and ethical value.

The Road Ahead

The evolution of Islamic and ethical finance has mirrored each era’s defining challenge. The early decades were about legitimacy, proving that faith and finance could coexist. The next was about scale - demonstrating that ethical systems could compete with conventional ones.

Now, the challenge is capacity: operationalizing principles across institutions, jurisdictions, and regulatory frameworks at digital speed.

That is what we are building at Blade Labs - infrastructure that transforms principles into policy logic and policy logic into measurable impact.

Because the purpose of technology in finance is not to replace human wisdom, but to extend its reach, enabling systems that are not only compliant, but truly ethical by design.