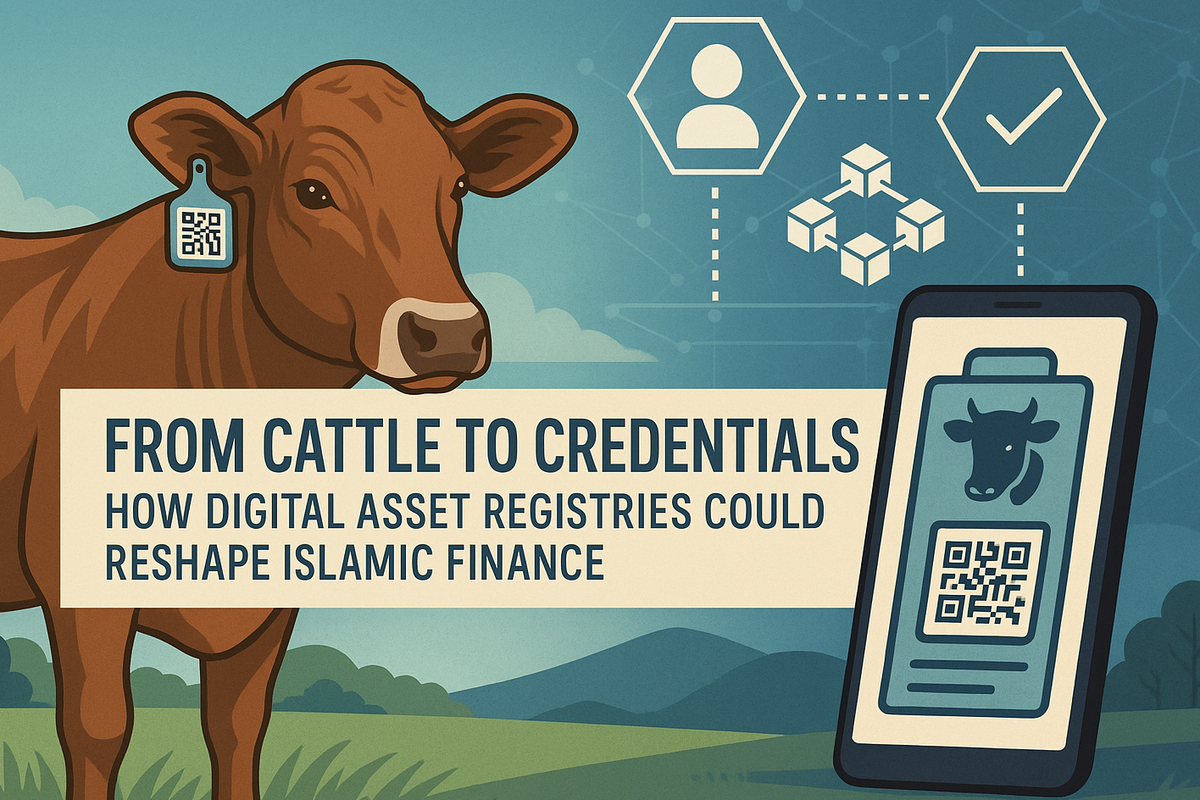

From Cattle to Credentials: How Digital Asset Registries Could Reshape Islamic Finance

When you think about revolutionary technology in finance, livestock tracking probably isn't the first thing that comes to mind. Yet at Blade Labs, our digital cattle pilot project offers a glimpse into the future of Islamic finance infrastructure, where physical assets gain digital identities and traditional trust mechanisms get a blockchain-powered upgrade.

The Trust Problem in Asset-Backed Finance

In Islamic finance, every transaction must be backed by real assets. It's a beautiful principle that keeps speculation at bay and grounds financial activity in tangible value. But here's the challenge: verifying those assets has traditionally been a nightmare of paperwork, manual inspections, and trust-but-verify bureaucracy.

Consider a smallholder farmer in rural Indonesia who owns cattle worth $5,000. In traditional systems, proving ownership requires community testimony, physical inspection, and a prayer that the ear tags haven't fallen off. For financiers and insurers, this uncertainty creates massive risk premiums that keep agricultural communities underserved.

Enter the Digital Asset Registry

This is where our pilot project gets interesting. We're building a digital asset registry that assigns a unique digital identity to every cow—think of it as a blockchain-based passport that travels with the animal throughout its lifetime. At the technical heart of this system are three key technologies: Decentralized Identifiers (DIDs), Verifiable Credentials (VCs), and distributed ledger infrastructure.

DIDs: The Foundation of Digital Identity

A DID is essentially a permanent, blockchain-anchored identity that doesn't rely on any centralized authority. In our cattle pilot, each animal receives a unique DID that looks something like did:ZeroH:00112233... This identifier becomes the anchor point for all information about that animal, from birth certificates to vaccination records to ownership transfers.

What makes DIDs revolutionary is their self-sovereignty. The entity controlling the DID (in this case, the farmer or platform guardian) can prove ownership by signing challenges with their private key. No central registry, no single point of failure, no bureaucratic bottleneck—just cryptographic proof of control.

Verifiable Credentials: Digital Certificates That Work

Building on the DID foundation, we use Verifiable Credentials to create tamper-proof digital certificates for every significant event in an animal's life. When a veterinarian examines a calf, they issue a "Birth Certificate" credential that's cryptographically signed and permanently linked to the animal's DID.

Our implementation goes beyond basic identification. Insurance policies become verifiable credentials automatically linked to the animal's digital identity. When a cow gives birth, we create a new DID for the calf and establish a verifiable digital link between mother and offspring—essentially creating a tamper-proof digital pedigree.

The beauty of this system lies in its selective disclosure capabilities. An investor might need to verify that their financed animal is alive and healthy, but they don't need access to its complete medical history. Our privacy-preserving mechanisms allow farmers to prove specific attributes without exposing underlying data.

The Platform as Digital Registry

In essence, our ZeroH platform becomes the digital livestock registry, with blockchain ledgers and distributed databases maintaining records of which DIDs belong to which owners and what credentials are associated with them. This creates what we call a "digital twin" for each animal within our distributed network.

For Sukuk issuance—where investors purchase Islamic bonds backed by real assets—this transforms everything. Instead of vague assurances about "100 cattle in a cooperative," investors get individual DIDs for each animal, complete with biometric identifiers (we use muzzle print patterns), ownership documentation, health records, and real-time status updates.

Early Implementation Insights

While our pilot is still in inception phases, the architectural decisions we've made address real market failures. Traditional identification methods like ear tags are prone to loss and tampering. RFID chips can be expensive and removed by determined fraudsters. Our digital approach creates trust where none existed before.

The economic implications are significant. By solving the identification challenge, we're turning previously "unbankable" livestock into credible collateral and insurable assets. This opens doors for scaling Islamic microfinance in agriculture, as investors can purchase Sukuk knowing the underlying assets are tracked with the same rigor as formal financial instruments.

The Road Ahead

As we move toward implementation, we're excited about the broader implications. Our digital cattle pilot isn't just about better farm management—it's about creating infrastructure that can digitize any physical asset for Islamic finance purposes. The same DID/VC architecture that works for livestock can be adapted for vehicles, real estate, commodities, or any asset class that needs transparent, Shariah-compliant tracking.

The future of Islamic finance lies in this marriage of ancient principles with modern technology. By giving physical assets digital identities, we're not just improving efficiency—we're preserving trust, ensuring transparency, and opening financial services to communities that have been historically underserved.

In a world where digital transformation often means sacrificing human values for technological efficiency, our approach does the opposite. We're using technology to uphold the ethical foundations of Islamic finance while making it more accessible, transparent, and effective.