Blockchain Technology Doesn't Replace Governance. It Enhances It

Part 2 of our Digital Receipts on Blockchain series

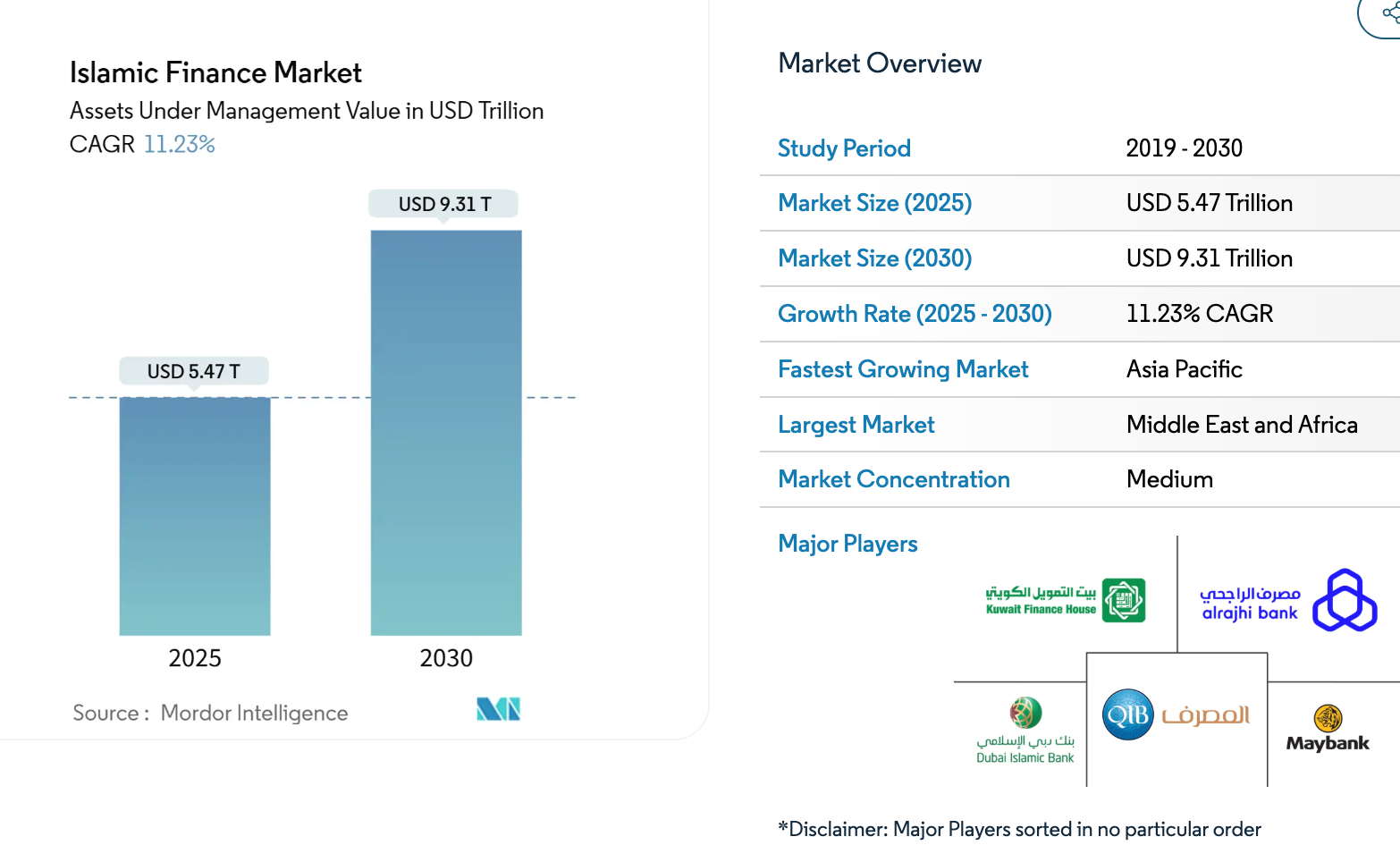

The Islamic finance industry, currently valued at more than $5 trillion, rests on strong governance, clear documentation, dual approvals, and Shariah oversight. Yet these safeguards often depend on paper-heavy systems that slow down processes, raise costs, and frustrate customers. At Blade Labs, working with Qatar Financial Centre, Al Rayan Bank, and Hashgraph, we set out to answer a critical question: can blockchain reduce these inefficiencies without compromising governance?

The result is our Digital Receipt System: a blockchain solution that enhances transparency, speeds up transactions, and strengthens auditability—while keeping paper contracts as the legal authority.

Transparency: Making Audit Trails Work for Everyone

Islamic finance requires transparency. Every transaction needs clear documentation, multiple approvals, and accessible records. Traditional paper-based systems handle this, but they create bottlenecks.

Our Digital Receipt System addresses these bottlenecks while keeping paper contracts as the legal authority. Here's how it works: when a customer makes a payment on their car financing, the blockchain records it instantly. Both the bank and customer can see the updated ownership percentage in real-time. The paper contract hasn't changed, but now there's an immutable digital record that anyone authorized can verify.

Dual-party validation isn't new to Islamic banking. What's new is that our smart contracts make it impossible to bypass. Both parties must digitally sign before ownership transfers. No exceptions. This protects both banks and customers while creating an audit trail that regulators can access anytime.

Asset-Backed Reality: Digital Records of Real Ownership

Islamic finance prohibits speculation. Every transaction must involve real assets. Our digital tokens reflect this principle; they represent actual ownership in physical assets, not abstract value.

Take automobile financing through Diminishing Musharakah. The customer gradually buys the car from the bank. Our system tracks each payment and automatically updates ownership percentages. The digital receipt shows exactly how much of the car the customer owns at any moment. It's not a new financial instrument, it's a digital record of an existing ownership structure.

This matters for practical reasons. Customers often need to prove ownership for insurance claims or resale. Banks need accurate records for compliance reporting. Our system provides both instantly, without creating any new financial products that would require additional Shariah review.

Shariah Integrity: Automated Checks, Human Decisions

Shariah boards spend significant time reviewing routine transactions for compliance. Our smart contracts handle basic compliance checks automatically, freeing scholars to focus on complex interpretations.

Here's an example: profit rate calculations in Murabaha transactions must follow specific rules. Our smart contracts verify these calculations before any transaction executes. If something violates the pre-set parameters, the transaction stops. The Shariah board still sets the rules; we just ensure consistent application.

This approach has practical benefits:

- Compliance violations get caught before they affect customers

- Banks reduce manual review costs

- Shariah scholars can focus on policy rather than routine validation

- Customers gain confidence that every transaction follows approved guidelines

Implementation Realities

Our proof of concept is designed to demonstrate practical capabilities. Transaction processing will achieve sub-2-second finality on the HashSphere network. Integration with existing banking systems requires careful API development. Privacy controls need to balance transparency requirements with customer data protection.

We're building four Islamic financing workflows: Murabaha, Commodity Murabaha, Mudaraba, and Musharakah. Each requires different smart contract logic. Working with Al Rayan Bank's team helps us understand the operational nuances:when ownership transfers, how profits calculate, what documentation each party needs.

The proof of concept addresses specific stakeholder requirements. Banks seek operational cost reduction and enhanced compliance assurance. Customers need real-time ownership proof and transparent processes. Regulators require comprehensive audit trails for oversight. Our system design focuses on meeting these documented business needs through blockchain technology.

Moving Forward

This initiative aims to explore how blockchain can bring efficiency and scalability to Shariah-compliant financial products. For Islamic financial institutions interested in this approach, the Digital Asset Lab framework demonstrates how blockchain infrastructure can support Shariah compliance processes while enabling operational improvements. The technical framework being validated could serve as a foundation for Islamic fintech innovation across multiple jurisdictions.

At Blade Labs, we're demonstrating that blockchain technology can enhance Islamic finance operations when implemented with careful consideration of business requirements and religious principles. The Qatar initiative provides a controlled environment to validate these solutions before broader market adoption.