AI for Capacity Building in Islamic Finance — The Blade Labs Vision

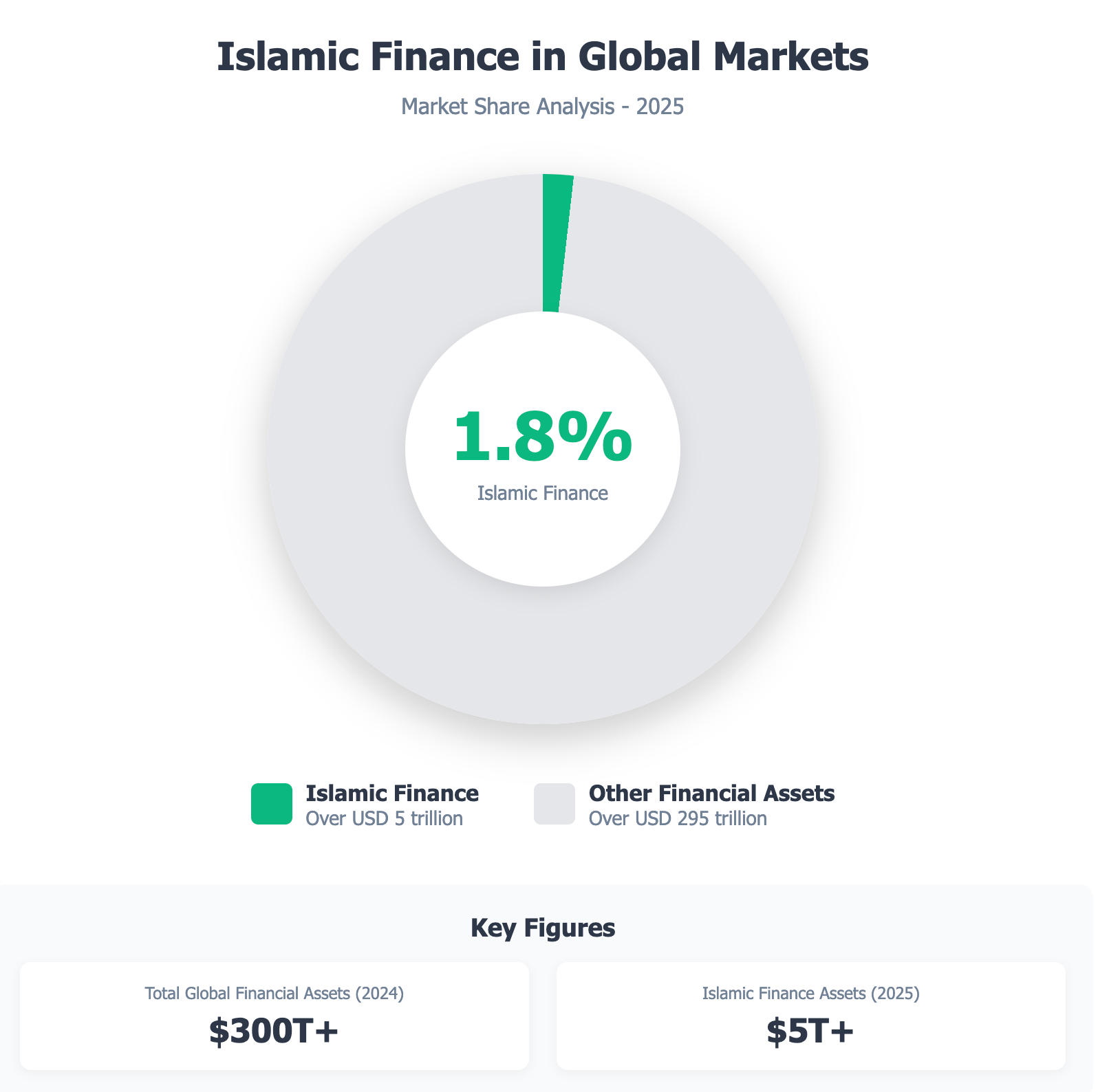

The global Islamic finance market is currently valued at over USD 5 trillion and yet, it represents only a small fraction of global financial assets. While the sector has grown steadily through strong regulatory and Shariah governance frameworks, its ability to scale remains constrained by operational complexity and manual compliance processes.

From Automation to Understanding

At Blade Labs, we believe the next leap for the industry lies not in faster automation but in deeper understanding. The true potential of artificial intelligence (AI) in Islamic finance is not merely to follow rules but to reason with them.

That’s what we call AI that reasons with Hikmah i.e. artificial intelligence guided by Islamic wisdom. Rather than automating checklist-based compliance, our systems evaluate purpose, sequence, and consequence, aligning each financial action with the higher objectives of Shariah (Maqasid al-Shariah): preserving faith (dīn), life (nafs), intellect (‘aql), family (nasl), and wealth (māl).

Illustration: In a simple Murabaha transaction, traditional compliance verifies whether the asset was purchased before resale, ensuring sequence. AI with Hikmah asks deeper questions: Was the asset genuinely needed? Does the markup serve a productive purpose? Is the payment structure sustainable for the buyer?

This shift from checklist compliance to purpose-driven reasoning is what we mean by embedding wisdom in code."

The outcome is capacity building, not just compliance automation but enabling Islamic financial institutions to scale their portfolios and reach underserved markets without proportionally increasing oversight or operational burdens.

Embedding Hikmah in Code

Islamic finance has always been about governance with purpose. Each contract from Murabaha to Mudarabah unites legal validity with moral intent. Translating that balance into digital infrastructure requires systems that can interpret contractual context, not just structure.

At Blade Labs, we are developing AI-assisted compliance systems that model the why, not just the what, of transactions. These systems combine rule-based logic with machine learning, include human-in-the-loop checkpoints, and operate under Shariah scholar oversight, ensuring automation remains authentic.

Our technology can identify contract structures, verify clause sequencing, and flag inconsistencies against approved templates. Over time, the models learn from scholar feedback, gradually improving contextual understanding without removing human authority.

We’re embedding Islamic wisdom directly into our algorithms, creating systems that don’t just follow rules but understand the higher objectives of Shariah. — Sami Mian, CEO, Blade Labs

Turning Philosophy into Practice

The Blade Labs vision is taking shape through development initiatives in several Islamic finance markets. Each illustrates how AI can enhance institutional capability, streamline governance, and widen access while preserving Shariah integrity.

1. Digital Receipt System — Trust Through Traceability

Status: PoC launched under QFC Digital Asset Lab

In traditional Musharakah financing, proofs of ownership and asset transfers often exist in fragmented paper trails, creating audit lags and uncertainty.

The Digital Receipt System (DRS) is designed to:

- Apply consensus-verified timestamps via Hedera Hashgraph to establish immutable transaction ordering.

- Generate real-time, auditable event trails accessible to regulators and Shariah boards.

- Anchor each transaction’s proof to its legal and ethical sequence.

Expected Outcome: Once deployed, the DRS aims to reduce Shariah audit cycles from weeks to near-real-time verification, a step toward continuous assurance frameworks.

2. Digital Livestock Financing Infrastructure — Inclusion Through Intelligence

Status: Pilot architecture design for initiation in Bangladesh; scalable infrastructure in progress for multi-market deployment.

The Digital Livestock Financing Infrastructure extends our vision of AI-enabled capacity building to one of the world’s most underserved sectors - livestock microfinance. Smallholder farmers often lack verifiable data to access ethical financing, insurance, or risk-sharing products.

This system brings together two complementary layers:

- DID/VC infrastructure that creates a verifiable digital identity (“digital twin”) for each animal using biometric identification and lifecycle records, including birth, vaccination, health, ownership, and insurance events. These records are cryptographically signed, ensuring authenticity and independent verification without centralized registries.

- AI-powered audit and risk intelligence that analyzes these verified records to detect anomalies, assess animal health and productivity, and generate automated compliance reports aligned with Shariah financing structures such as Mudarabah and Murabaha.

Together, these layers form an ecosystem where every financed asset can be monitored, audited, and verified in real time, reducing fraud risk, improving transparency, and enabling financiers to extend capital with confidence.

The framework is designed to be scalable across markets, starting with livestock and extendable to other movable assets such as vehicles or machinery, creating a digital foundation for inclusive, ethical asset financing in the Islamic economy.

Target Impact: Enable inclusive financing models that reach thousands of underserved producers while maintaining ethical transparency and Shariah alignment.

Here, AI becomes an enabler of inclusion and economic justice — reasoning about need, impact, and dignity, not just risk.

3. Smart Contract Infrastructure for Islamic Finance Products — Automating Shariah Compliance

Status: Product development stage

Islamic finance institutions face significant operational complexity in executing Shariah-compliant transactions, particularly in structures requiring precise sequencing, multi-party coordination, and continuous compliance verification. Manual processes create bottlenecks that limit institutional capacity to scale portfolios efficiently.

We are developing smart contract infrastructure that covers foundational Islamic finance products that embed Shariah logic directly into transaction execution.

Commodity Murabaha — Liquidity Through Automated Compliance

Overview: Commodity Murabaha enables liquidity provision through real commodity trades, maintaining Shariah compliance while meeting modern liquidity needs.

Technical Infrastructure:

- Automated transaction sequencing: Smart contracts enforce the correct order of operations — purchase → sale to customer → sale to broker — eliminating risk of non-compliant sequencing.

- Real-time profit calculation: Automated computation of profit margins and installment schedules aligned with agreed terms.

- Commodity platform integration: APIs link directly to commodity trading platforms for real-time pricing and execution.

- Digital documentation: Verifiable Credentials replace paper documents for each phase, creating tamper-proof audit trails.

- Blockchain verification: Immutable records of transaction sequence ensure adherence to AAOIFI Standard No. 8.

This infrastructure transforms a traditionally manual, multi-step process into an automated workflow, reducing execution time from days to minutes while maintaining full Shariah compliance.

Diminishing Musharakah — Co-Ownership with Automated Transfer

Overview: Diminishing Musharakah enables joint ownership where one party gradually acquires the other’s share, a structure often used for real estate and asset financing.

Technical Infrastructure:

- Ownership registry management: A digital asset registry tracks proportional ownership as it shifts from joint to sole ownership.

- Dual payment automation: Smart contracts separate and process rental and equity acquisition components automatically.

- Progressive equity calculation: Real-time tracking of ownership percentages as the customer acquires the financier’s share.

- Milestone-based transfers: Ownership transfer automated upon completion of agreed payment schedules.

- Compliance verification: Embedded logic ensures rental rates and acquisition terms remain Shariah-compliant throughout the lifecycle.

By automating ownership transitions and payment structures, this infrastructure enables institutions to offer Diminishing Musharakah products at scale, addressing a financing model that has historically been operationally intensive.

Both smart contract systems reflect Blade Labs’ approach to capacity building: embedding Shariah compliance into the transaction layer itself.The result - institutions can scale their Islamic finance portfolios without proportional increases in compliance staffing or operational overhead.

The Blade Infrastructure Stack

Behind these initiatives lies the Blade Infrastructure Stack - the foundation of our AI-enabled, Shariah-compliant ecosystem.

1. Digital Asset Registry: A cryptographically sealed system binding ownership proofs, Shariah endorsements, and consensus timestamps into verifiable digital credentials, replacing fragmented records with an auditable, tamper-evident framework.

2. AI-Assisted Compliance System: A hybrid rule-based and ML-driven framework that supports clause verification, contract classification, and continuous compliance auditing, always under human and Shariah supervision.

3. DID/VC Framework (in implementation): Built on W3C Verifiable Credentials and Decentralized Identifiers (DID) standards. Enables privacy-preserving KYC, cross-institutional credentialing, and interoperable governance. Implementation is progressing across pilot environments, guided by a unified source-of-truth architecture.

4. Smart Compliance Layer: Embedded Shariah logic enabling real-time oversight and automated reporting, turning episodic audits into continuous compliance.

Together, these components form our AI Capacity Grid, a robust infrastructure designed to strengthen institutions rather than replace them.

The intersection of artificial intelligence and Islamic finance represents a transformative opportunity to make ethical financial principles accessible to millions. — Sami Mian

When AI Thinks With Wisdom

The future of Islamic finance will not be defined by new products alone — it will be coded into systems that embody its values.

AI that reasons with Hikmah does not replace scholars or regulators; it amplifies their reach and ensures their intent translates digitally.

As AI reshapes finance globally, Islamic finance has a rare opportunity to lead, demonstrating that technology, when guided by wisdom, can power inclusion, integrity, and human flourishing.

At Blade Labs, we’re building the infrastructure to make that possible.